Pope Leo XIV, born Robert Francis Prevost, was elected as the 267th Pope of the Catholic Church on May 8, 2025, following the death of Pope Francis. He is the first American pope.

Continue reading

Pope Leo XIV, born Robert Francis Prevost, was elected as the 267th Pope of the Catholic Church on May 8, 2025, following the death of Pope Francis. He is the first American pope.

Continue reading

Archbishop Elpidophoros of America presents President Trump with a Holy Cross on March 24, 2025 during the Greek Independence Day celebration at the White House. The Archbishop praised Trump for his support of Christian communities in the Middle East and compared him to Emperor Constantine the Great. Watch:

Continue readingOn September 4, 2024, a news headline reported that “JD Vance’s Catholicism helped shape his views. So did this little-known group of Catholic thinkers.”

Continue reading

On March 29, 2024, Roman Catholic President Joe Biden has declared Easter Sunday a Transgender Day of Visibility promoting transgenderism as a cornerstone of its policy agenda.

Continue reading

On February 14, 2024, the La Sierra SDA church posted, “Day 1 – Love and Ashes… This Valentine’s Day is also Ash Wednesday. It’s a day when many Christians from different traditions around the world will attend a service and receive ashes on their foreheads in the shape of a cross. The person administering the ashes may say, “Remember that you are dust, and to dust you shall return,” or “Repent and believe in the Gospel… Over the next 40 days, during Lent, leading us through to four days with Jesus, community members will be sharing personal stories of when a word from God helped them go on… The Church landed on fasting for 40 days before Easter because of the 40 days and 40 nights Jesus spent in the wilderness after his baptism. ”

Continue reading

On January 22, 2024, a news headline reported that “‘No cash accepted‘ signs are bad news for millions of unbanked Americans.” It goes on to say that “People without bank accounts are shut out from stores and restaurants that refuse to accept cash… Numerous shops had one sign proudly proclaiming how welcoming and inclusive they were — next to another sign saying “No cash accepted.” This tells people without bank accounts that they aren’t welcome.”

Continue reading

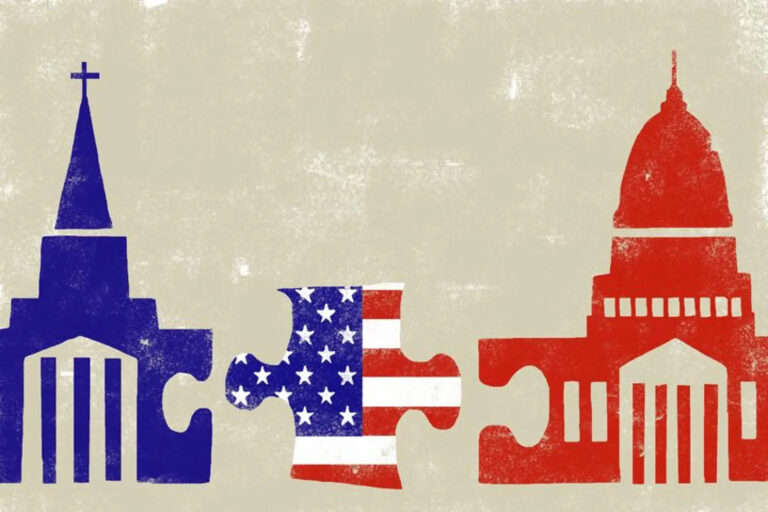

Back in 1893, the SDA pioneers resolved to decline to accept exemptions from the State for they believe and uphold the separation of Church and State. Proof? Please refer to the excerpts I posted below from Daily Bulletin of the General Conference, vol. 5, no. 20, page 437:

Continue reading

How does one blaspheme the Holy Ghost?

Jesus Christ said in Matthew 12:31-32, “Wherefore I say unto you, All manner of sin and blasphemy shall be forgiven unto men: but the blasphemy against the Holy Ghost shall not be forgiven unto men. And whosoever speaketh a word against the Son of man, it shall be forgiven him: but whosoever speaketh against the Holy Ghost, it shall not be forgiven him, neither in this world, neither in the world to come.”

Continue reading

On December 9, 2023, the Breitbart.com reported that the “Satanic Temple set up a holiday homage to the occult “deity” Baphomet in the Iowa Statehouse, drawing concern from Christians about the “abhorrent” and “evil” display.”

Continue reading

As many are aware that have seen all my videos posted on my climate change page over the last few years, the Pope is planning to demand Sunday laws to stop climate change. In fact, the United States Government’s “Project 2025” is concrete proof the prophecy is very soon in fulfilling. BUT, what the Pope sent to the COP28 U.N. Climate Summit in Dubai yesterday (December 03, 2023) declares we are MUCH CLOSER to Sunday Laws than ever before.

Continue reading